"I am announcing collecting donations for the ddos of mtgox for decreasing exchange rates! haxorz! please send letter to support@btcex.com and give your money for that work!" - BTCex Admin Bitcoinex[1]

A few short days after the above post on the Bitcoin forums, MTGox began to suffer a sustained DDoS attack[2]. Fingers were quickly pointed at BTCex, especially given that much of the attack originated from Russian IP's[2]. Bitcoincex denied involemnt with this, commenting that his previous post had only been a joke[3], but didn't help his case by commenting that "I welcome this attack"[4]. The Russian bitcoin community were quick to condemn the attacks, and Bitcoinex explained that he had only made that comment because he was afraid of the Bitcoin economies over dependance on MTGox. Perhaps fellow russian bitcoin forum user Yurock said it best when stating "bitcoinex, maybe you have too "Russian" nature and manner of communication. Not all is understood."[3]

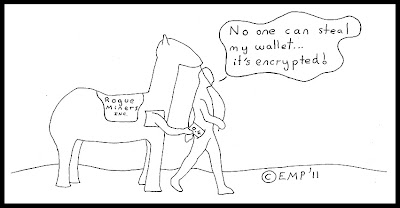

The problem though may run a little deeper than a clash of cultures. The key issue, as is often the case with the Bitcoin world, is trust, especially in a pseudo-annonymous system. A good way of highlighting this problem is to look at the companies behind the key competitors in this market. Tradehill, the second biggest player, has an extensive legal policy on its website including a Privacy Policy Customer pledge. However, immediatly above this pledge is a Portland, US address for trade hill including an email address and phone number[5]. They key is that whilst they strive to ensure customer privacy rights are protected, they offer full disclosure in terms of who they are. The biggest player in the market, MTGox, goes even further. MTGox, is owned by Tibanne Co. Ltd. was incoporated in Tokyo in 2009, and has Tokyo contact details [6]. The operator Mark Karpeles, aka Magical Tux, is a 25 year old french developer who lives in Japan. You can follow him on twitter [7], check out his flickr feed[8], even follow his blog[9]. In fact he has such an extensive internet trail, you can even discover that he can make apple pies and has a cat [9]! In contrast to all of this, about the only thing you will uncover relating to Bitcoinex is that he is also the operator of gambling site probiwon.com...

Of course, it is posible to have both anonymity and trust. A good example of this are some of the more high profile members of the bitcoin community such as pool administrators who are well known and trusted by their handles. In these cases the individuals have built up trust through their contributions to the community, and the length of time they have been involved. Tsiakis and Sthephanides summarised this by stating that there are two ways to gain trust[10]. You can have a web of trust based on informal relationships as bitcoin users have with pool adminsitrators. Or you can have certificating authorities, such as those authorities that monitor incorporated companies. The former system allows greater annonymity, but takes more time to build up. This then may be Bitcoinexs problem, he has opted to build trust annonymously, but his contributions to the bitcoin community have caused some to doubt his behaviour.

A final thought is that Bitcoinex's concerns are in fact reasonable, even if his aggressive statements in regard to this were a mistake. The problem of concentrating too much traffic in one exchange is that the exchange becomes a monopoly since the large volumes allow it to grant more favourable deals. Once a monopoly of this type is established, the risk is the exchange imposing restrictions and rates as a central controlling entitiy might for a traditional currency. Encouraging competition is one avenue to avoid this porblem, and hopefully the use of geographically local exchanges will encourage this to avoid bank charges. Another intriguing option is the idea of a decentralised exchange which has been suggested[11]. One thing is for certain, as the Bitcoin economy matures, we can expect to plenty more action in the exchange market as companies and individuals live, and die by their level of trust.

[1]http://forum.bitcoin.org/?topic=6864.msg101352#msg101352

[2]http://forum.bitcoin.org/index.php?topic=6931.20

[3]http://forum.bitcoin.org/index.php?topic6950.0

[4]http://forum.bitcoin.org/index.php?topic=6864.0

[5]https://www.tradehill.com/Support/Legal

[6]http://www.tibanne.com

[7]http://twitter.com/#!/magicaltux

[8]http://www.flickr.com/people/magicaltux/

[9]https://en.bitcoin.it/wiki/User:MagicalTux

[9]http://blog.magicaltux.net/

[10]http://www.spinaltwist.eclipse.co.uk/Files/Dissertation/Tsiakis.%20Sthephanides%20-%20The%20concept%20of%20security%20and%20trust%20in%20electonic%20payments.pdf

[11]http://forum.bitcoin.org/index.php?topic=27055.0